How it works

The current tax system seems to epitomise Kerry Packer’s words…

“Anyone who doesn’t minimise their tax, needs their head read.”

At Scholarship Saviour we analyse your income and come up with the right strategy, based on your individual circumstances – and then adapt the strategy when and if circumstances change.

Our parad igm is based on Robert Kyosaki’s “Rich Dad Poor Dad”. Also, the book “How To Legally Reduce Your Taxes”. Using a combination of these principles we’re able to help working class families achieve their goals.

igm is based on Robert Kyosaki’s “Rich Dad Poor Dad”. Also, the book “How To Legally Reduce Your Taxes”. Using a combination of these principles we’re able to help working class families achieve their goals.

We are using top accounting and legal advice, which has been the exclusive domain of the rich, giving them the know how that has enabled them to minimise their taxes down to very little.

When you are classified as a ‘middle class’ family, you are penalised. Those people who are considered to be a minority or from a disadvantaged background have some advantages over the hard-working middle class family, government handouts and benefits.

The fact is, if you have money in the bank you pay tax on it, based on your earnings. For example, if you pay a tax rate of 45 cents in the dollar, your money in the bank currently earns 3.5% – then after tax you get a return of approx 2%.

Conversely, if you borrow money for investing you get a tax deduction on the interest that you pay. So if you borrowed say $50,000 at 6%, your interest would be $3,000 p.a. The $3,000 interest bill would then attract a tax deduction of $1,350 based on 45% tax bracket. If you were to invest that money in an investment property you would get a return. However, with Scholarship Saviour we use existing tax rules and can direct that money to your children, which will then be tax free.

Through smart tax lawyers and accountants we source the best advice. As an individual seeking this advice, you would find the costs prohibitive. We have secured the advice for families at low cost, because we can spread out the tax advice over a group of people in similar situation.

Assessment

Each case is treated individually.

Structure

Again without going into too much detail here, we assess each individual for the best possible solution.

This can be in the form of either a unit holder in a trust, this form is much more flexible in that we can assign the units prior to sale to someone who has a lower tax bracket. Alternatively, you may wish to have direct participation on the title as ‘Tenants in Common’. Obviously, when you make an appointment we will go through all of these priorities in much greater detail.

Once you become a client of Scholarship Saviour we strongly recommend you allow us to do your tax return. This is because we have experts in Tax Advice, being distinct from just Accountants. Over the years we have had clients who have found out the hard way, which is why we offer this service.

Scholarship Saviour can also assist parents who are separated and need to sort their financial matters, especially around maintenance. Using a template, we have a clause in the deed that quarantines the investment. It cannot be used for any purpose other than educating the children. We can vary the deed once the child has reached the age of 18, at which age the young person can work part time, without affecting this arrangement. We can also amend the deed, should educational plans change, to take into account the changing circumstances.

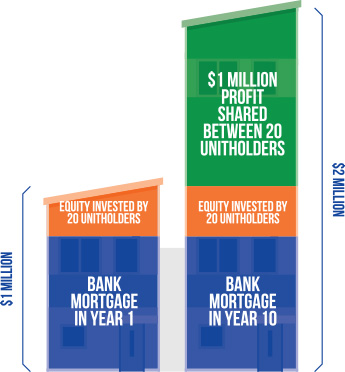

Ten Year Growth

Ten Year Growth

Real estate is a proven performer over time. It also provides a monthly income to offset the loan on a property.

There is a general belief that real estate doubles every seven years. At Scholarship Saviour we are more conservative and work on every 10 years.

Scholarship Saviour is designed for a 10 year plan, as is seen in this example.

With the help of Scholarship Saviour, you can also give your child the chance to own their own home much sooner. Without the burden of HECS, you can kick start their journey into home ownership – a real head start for future financial success.

Forward planning now can save your child from heavy future HECS debts.

Insurance

In the event of a tragedy we include free insurance, either due to a death by accident or a disability. *conditions apply