About us

FOUNDER AND CEO

Vincent Scali

Vincent Scali began his career in real estate in 1978 with his own business, Vincent Scali & Co. Since then he has gained broad experience in property development and management, as a land agent, and developer, builder.

He has a wealth of experience in all facets of Real Estate spanning over 40 years.

With this level of experience, Vincent is well respected in the property industry for his solid advice, honesty and commitment to helping families achieve financial success and security.

With this paradigm he has assisted families in providing an education for their children with minimal outlay while creating capital growth and negative gearing where applicable, thereby negating the fees their children have to pay upon completion of their degrees. This gives them a clean start to their careers without the burden of HECS fees for the next 10 to 20 Years.

LONG TERM GOALS

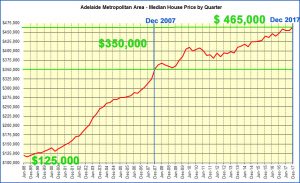

The most common platform for creating wealth is Real Estate. Whilst it does go up and down over a short time span it invariably goes up over a longer period

PROPERTY V SHARES

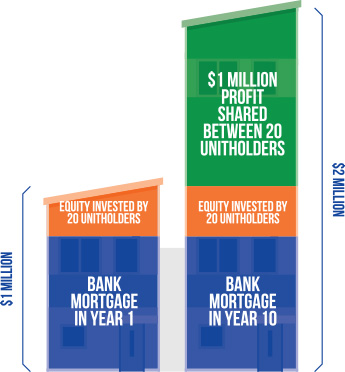

When comparing real estate versus the stock market, real estate allows you to gear the investment. This is also called leverage where our initial investment can triple in value. You are a decision maker, where as in shares decisions are made by a board of directors.

TEN YEAR GROWTH

Real estate is a proven performer over time. It also provides a monthly income to offset the loan taken on property.

There is a general belief that real estate doubles every seven years. At Scholarship Saviour we are more conservative and work on every 10 years.

Scholarship Saviour is designed for a 10 year plan, as is seen in this example.

With the help of Scholarship Saviour, you can also give your child the chance to own their own home much sooner. Without the burden of HECS, you can kick start their journey into home ownership – a real head start for future financial success.

Example of Growth Over a Ten Year Period

Forward planning now could also give your child the freedom to focus solely on studying, hopefully leading to even better academic results.

You will also reduce the pressure to pay off higher education fees when full time work begins.

Then there is the opportunity for tax deductions which can be used to your advantage. The use of these tax deductions are not

easily understood by some accountants. So we will service you with our TAX SAVIOURS who understand the myriad of tax laws, thus achieving the optimum tax savings for you.

DUE DILIGENCE

In this day and age it is important carry out due diligence.

There are a number of cases which have either been before the courts or are currently ongoing. This is due to faulty workmanship which plagued the building process. Having industry experience we can soon establish if the builder is bona fide.

Purchasing a finished project you can make the relevant inquiries and then building inspections. This is prudent, so you know what to expect rather than being hit with a large levy being imposed on the strata corporation which you will then be liable for your portion.( should your investment be in a department block)

ALL INCLUSIVE

When you become a member of Scholarship Saviour you will have all the above reports provided to you. It is then an only then you can make an informed decision as to whether to participate in that project or not. Once you decide we can take care of the rest, you can relax and just go about your day to day activities.

Remember the old adage…